In the latest financial update, Zomato, one of India’s leading online food delivery platforms, has reported a significant decline in its net profit for the third quarter (Q3) of the fiscal year 2025. The company’s net profit dropped by 57.2%, reaching ₹59 crore compared to the same quarter in the previous year. This sharp decline has raised concerns among investors and industry analysts, especially given Zomato’s growth trajectory and the competitive nature of the online food delivery sector.

This article will explore the factors contributing to Zomato’s decreased profits, the company’s overall performance, its future outlook, and the potential impact on the food delivery industry. We’ll also discuss Zomato’s strategies to address the challenges it faces, including increased competition, rising operational costs, and shifting consumer behavior.

1. Zomato’s Q3 Financial Overview

In the financial year 2025, Zomato reported a marked decline in its net profit for Q3. The company earned ₹59 crore in profits, a sharp drop from the ₹138 crore reported during the same quarter last year. This 57.2% decline has triggered concern among investors who were expecting stronger performance from the food delivery giant.

Despite this profit decline, Zomato continued to see substantial revenue growth during the quarter. This indicates that while the company is expanding, it is facing significant pressure on its profitability due to several factors.

Key Financial Figures for Q3:

- Net Profit: ₹59 crore (a decline of 57.2% year-on-year)

- Revenue: Despite the profit drop, the company’s revenue saw an increase, signaling continued demand for food delivery services.

- Gross Profit Margins: Margins have been impacted by rising delivery and operational costs, affecting the bottom line.

- Operational Costs: Higher than expected, especially with rising delivery costs and incentives.

These figures reflect the challenges Zomato is facing despite a growing market and significant brand presence.

2. Factors Contributing to Zomato’s Profit Decline

Several factors have contributed to the decline in Zomato’s net profit for Q3. Some of the most significant include:

A. Rising Operational Costs

Zomato, like other food delivery platforms, has been facing rising operational costs. Key contributors include:

- Delivery Costs: As fuel prices increase and delivery personnel costs rise, Zomato has seen a sharp increase in the cost of fulfilling orders.

- Marketing Spend: The company has increased its marketing expenditure to retain customers and compete with rivals like Swiggy. While this is crucial for growth, it has placed pressure on the company’s margins.

- Rising Technology Investments: Zomato is investing heavily in technology to streamline its platform, develop new features, and improve user experience. However, these investments come at a cost.

B. Intense Competition

Zomato faces fierce competition from rival platforms like Swiggy and Amazon Food. These competitors have been offering deep discounts, cashback offers, and other incentives to attract and retain customers, which has put pressure on Zomato’s pricing strategy and profit margins.

C. Consumer Behavior Changes

Changes in consumer behavior, including increased demand for cheaper meal options and preferences for non-contact delivery, have impacted Zomato’s business. The post-pandemic era has seen fluctuating demand as consumers return to dining out or opt for cheaper home-cooked meals, reducing the reliance on food delivery services.

D. Regulatory Challenges

The Indian food delivery market faces increasing scrutiny and regulation from local authorities. Rising taxes, delivery regulations, and wage-related policies have increased the operational complexity for Zomato, affecting its profitability.

3. How Zomato Plans to Address These Challenges

Despite the profit drop, Zomato remains committed to addressing these challenges head-on with several strategic moves. The company is focusing on the following areas:

A. Expansion into New Markets

Zomato continues to expand its presence in smaller cities and international markets, looking to tap into underserved regions. By diversifying its customer base, Zomato aims to increase order volumes, offsetting the impact of declining profits in existing markets.

B. Subscription and Loyalty Programs

Zomato has been focusing on subscription models like Zomato Pro and loyalty programs to ensure repeat business. These programs provide members with discounts, free delivery, and other benefits, helping to drive customer retention.

C. Efficiency Improvements

Zomato is investing in artificial intelligence (AI) and machine learning (ML) to optimize its delivery logistics, reduce costs, and improve efficiency. AI-driven algorithms can help predict demand patterns, optimize delivery routes, and manage resources better.

D. Diversifying Services

Zomato is exploring additional revenue streams, such as:

- Zomato Market: Offering grocery delivery services.

- Cloud Kitchens: Expanding into the cloud kitchen business, which involves setting up kitchens for restaurants to prepare food for delivery-only orders.

These new ventures aim to improve Zomato’s bottom line and reduce its reliance on the core food delivery business.

4. Market Reactions and Investor Sentiment

Zomato’s Q3 financial results have sparked mixed reactions from investors. While the company’s revenue growth indicates that there is still substantial demand for its services, the significant profit decline has led to concerns about its long-term profitability.

Investor Reactions:

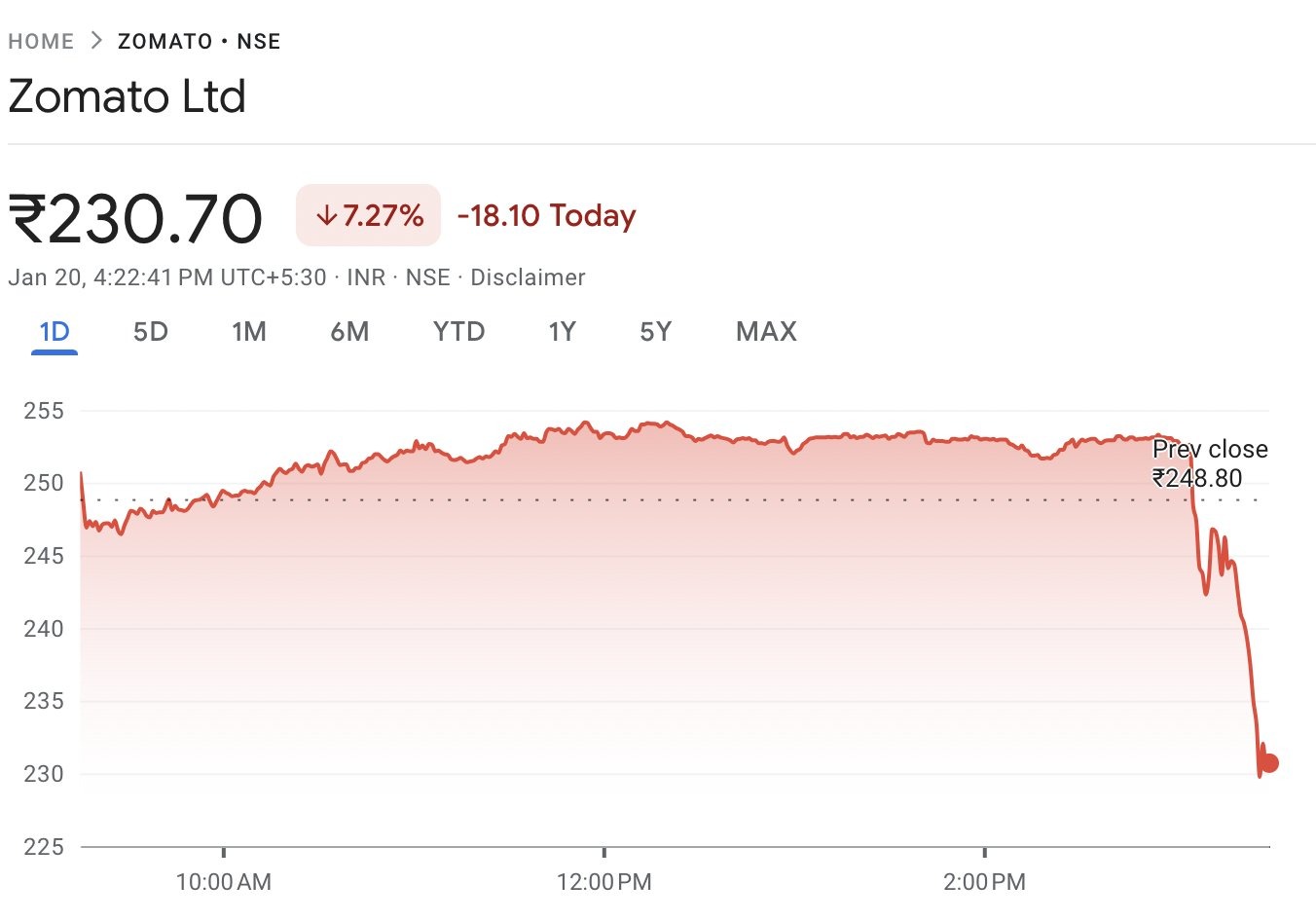

- Stock Performance: Zomato’s stock price has faced pressure in the days following the announcement of the Q3 results. Analysts have noted that investors are likely concerned about the company’s ability to maintain profitability amid growing competition and rising operational costs.

- Future Outlook: Some investors are cautiously optimistic, betting on Zomato’s expansion strategies and diversification efforts to drive growth in the long term. However, others are wary of the company’s ability to balance growth with profitability in the competitive food delivery sector.

5. Comparing Zomato’s Performance with Competitors

Zomato’s profit decline can be better understood when compared to the performance of its competitors in the food delivery space. While all platforms have faced challenges related to operational costs and competition, it is important to assess how Zomato’s rivals are performing.

A. Swiggy’s Strategy

Swiggy, Zomato’s primary competitor, has seen similar challenges in terms of rising operational costs. However, Swiggy has focused on:

- Expanding into new services: Swiggy has diversified its services, including grocery delivery through Instamart and cloud kitchen ventures.

- Strategic Acquisitions: The company has made strategic acquisitions to strengthen its tech stack and operational efficiency.

While Zomato has made similar moves, Swiggy’s ability to secure strong partnerships and expand its service offerings has given it a slight edge in terms of market share.

B. Amazon Food

Amazon Food, although still in its infancy, is gaining traction as a challenger to both Zomato and Swiggy. Leveraging Amazon’s vast logistics network and deep pockets, Amazon Food is able to offer significant discounts and cashback offers, which could further increase competition in the sector.

6. Industry Impact: What This Means for the Future of Food Delivery

Zomato’s declining profits are reflective of broader trends in the online food delivery industry. As competition heats up and operational costs continue to rise, platforms will need to find ways to adapt and innovate to remain profitable.

Key trends to watch include:

- Subscription Models: The continued rise of subscription models as platforms seek to generate more predictable revenue streams.

- Technology-Driven Innovation: Increased reliance on AI and machine learning to optimize delivery networks, reduce costs, and improve customer experience.

- Vertical Integration: The move towards cloud kitchens and grocery delivery services as platforms seek new revenue streams outside of traditional delivery models.

These shifts will likely define the future of the food delivery industry, with both established players like Zomato and new entrants having to navigate a challenging market environment.

7. Conclusion: The Road Ahead for Zomato

Zomato’s Q3 financial results highlight the complexities and challenges facing the online food delivery sector in 2025. While the company’s revenue growth is a positive sign, the sharp decline in net profit underscores the pressures of competition, rising costs, and shifting consumer behavior.

However, Zomato’s efforts to diversify its services, expand into new markets, and improve operational efficiency suggest that the company is taking the right steps to navigate these challenges. The future of the company will depend on its ability to balance growth with profitability, especially in the face of intense competition from Swiggy, Amazon Food, and others.

In conclusion, while Zomato faces a turbulent path ahead, its ability to innovate, adapt to changing market conditions, and expand into new areas will likely determine its long-term success in the competitive food delivery industry.