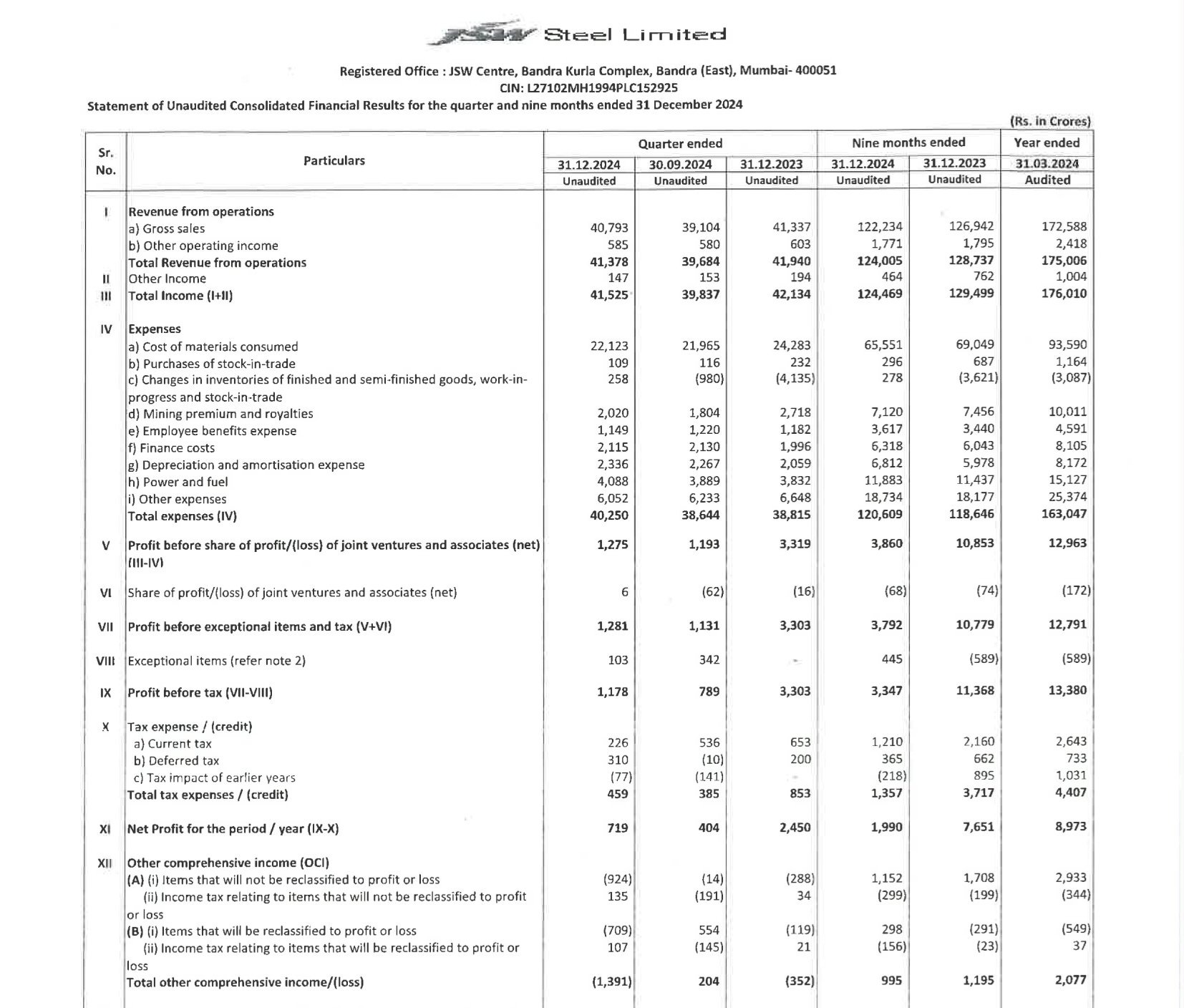

JSW Steel, one of India’s leading steel manufacturers, reported a sharp 70% decline in net profit for the third quarter of the fiscal year, posting ₹719 crore compared to ₹2,439 crore during the same period last year. The company attributed the slump to weaker global steel demand, rising input costs, and softening steel prices.

Key Highlights of Q3 Performance

- Revenue Decline

- Total revenue from operations stood at ₹39,134 crore, down 12% year-on-year, reflecting lower realizations in both domestic and international markets.

- EBITDA and Margins

- Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) dropped by 46% to ₹4,500 crore, as higher raw material costs squeezed margins.

- EBITDA margin was recorded at 11.5%, compared to 18.6% in the same quarter last year.

- Production and Sales

- Crude steel production rose marginally by 2% to 6.27 million tonnes.

- Sales volumes increased by 3% year-on-year, but lower realizations in key markets led to reduced profitability.

- Impact of Rising Input Costs

- Higher costs of coking coal, energy, and logistics adversely impacted overall production expenses.

Factors Contributing to the Profit Decline

- Global Steel Market Weakness

- The global steel industry faced demand contraction amid an economic slowdown in major markets such as China and Europe.

- Volatile geopolitical conditions, including the ongoing Russia-Ukraine conflict, disrupted trade routes and steel exports.

- Softening Steel Prices

- Steel prices have been declining since mid-2024 due to oversupply and sluggish infrastructure spending globally.

- Domestic prices also fell as demand from construction and automotive sectors weakened.

- Currency Fluctuations

- Depreciation of the Indian Rupee increased the cost of importing raw materials like coking coal.

Management’s Perspective

Seshagiri Rao, Joint Managing Director and Group CFO of JSW Steel, acknowledged the challenging macroeconomic environment but emphasized the company’s resilience:

“Despite headwinds, we focused on maintaining operational efficiency and optimizing costs. While global demand remains subdued, we expect recovery in the coming quarters driven by infrastructure projects and government initiatives.”

Future Outlook

- Recovery in Demand

- The Indian government’s emphasis on infrastructure development and housing projects under the PM Gati Shakti plan could drive domestic steel consumption.

- Internationally, recovery in China’s real estate market is expected to stabilize steel prices.

- Sustainability and Innovation

- JSW Steel is investing heavily in green steel technology and aims to reduce its carbon footprint by 42% by 2030.

- The company is also expanding its product portfolio to include higher-value steel products.

- Capacity Expansion

- Ongoing capacity enhancement projects, including the Dolvi and Vijayanagar expansions, are expected to add significant production capacity in the next fiscal year.

- Input Cost Optimization

- Diversifying sourcing for coking coal and improving supply chain efficiencies remain key priorities to combat rising raw material costs.

Analysts’ Take

Market analysts remain cautiously optimistic about JSW Steel’s medium- to long-term prospects:

- Positives: Strong domestic demand, infrastructure push, and capacity expansions.

- Concerns: Volatile global demand, high debt levels, and input cost inflation.

Conclusion

While JSW Steel’s Q3 performance reflects ongoing challenges in the steel industry, the company’s strategic initiatives and focus on sustainability position it for growth in a recovering market. As global and domestic conditions stabilize, JSW Steel’s investments in capacity and technology are likely to yield positive results in the coming quarters.