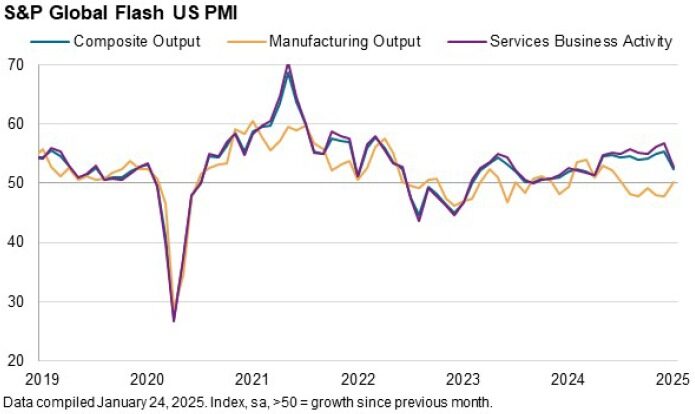

Private sector activity across key markets saw a significant deceleration in January, according to the latest Flash Purchasing Managers’ Index (PMI) report. The composite PMI, which measures output in both manufacturing and services sectors, fell to its lowest level in 14 months, indicating mounting pressures on economic recovery amid subdued global demand and inflationary concerns.

Key Highlights of the Flash PMI Report

- Decline in Composite PMI

- The composite PMI dropped to 48.7 in January, down from 50.5 in December, signaling contraction in overall business activity. A PMI reading below 50 indicates economic contraction, while above 50 signals expansion.

- Manufacturing PMI

- Manufacturing PMI slid to 49.2, marking its weakest performance in over a year. Weaker export orders and reduced inventory levels contributed to the slowdown.

- Services PMI

- Services PMI also experienced a downturn, registering 47.9 as consumer demand softened and companies grappled with rising input costs.

Factors Behind the Decline

- Weak Global Demand

- Persisting challenges in the global economic environment, including slowing growth in major markets such as China, the Eurozone, and the United States, weighed heavily on exports and private sector investment.

- Inflationary Pressures

- Input costs remained elevated due to high energy prices, supply chain disruptions, and fluctuating commodity prices. Businesses reported struggling to pass on these costs to consumers, leading to margin pressures.

- Higher Interest Rates

- Aggressive monetary tightening by central banks in response to inflation has dampened investment and consumer spending, further slowing private sector activity.

- Employment Trends

- Hiring activity slowed as businesses exercised caution in the face of uncertain demand, with many focusing on cost-cutting measures rather than expansion.

Sector-Specific Impacts

- Manufacturing Sector

- Key industries such as automotive, construction materials, and electronics reported reduced order volumes.

- Export-oriented firms faced challenges due to declining global trade and currency volatility.

- Services Sector

- Hospitality, travel, and financial services were among the hardest-hit areas as consumer spending weakened.

- Businesses in technology and consulting reported lower client acquisition rates compared to the previous quarter.

Regional Trends

- Asia-Pacific

- Several economies in the region reported contraction, with slowing Chinese demand being a major factor. India and Japan recorded muted growth in services and manufacturing activities.

- United States

- The U.S. private sector witnessed its second consecutive month of contraction, with the PMI falling to 46.8, reflecting reduced consumer spending and rising borrowing costs.

- Eurozone

- The Eurozone PMI slipped further below the 50-mark, with Germany and France leading the slowdown due to energy costs and reduced industrial activity.

Economic Implications

- Growth Forecasts

- Analysts expect global growth forecasts for 2025 to be revised downward if the slowdown in private sector activity persists.

- The IMF and World Bank have already flagged risks of stagflation and uneven recovery across regions.

- Policy Responses

- Central banks may need to reassess their monetary tightening strategies to avoid stifling growth further. Some economies could pivot to more accommodative policies if inflationary pressures ease.

- Corporate Earnings

- Businesses in sectors like manufacturing, retail, and services are expected to report subdued earnings for the first quarter of 2025, reflecting weaker demand and high costs.

Expert Insights

Economists suggest the slowdown is a reflection of cumulative pressures from 2024, including high interest rates, geopolitical uncertainties, and persistent supply chain challenges.

“The private sector is grappling with a perfect storm of challenges. While inflation may have peaked, the demand recovery remains fragile. Policymakers will need to strike a balance between curbing inflation and supporting growth,” said Dr. Rajiv Mehta, an economist at Global Insights.

Potential for Recovery

- Resilient Sectors

- Healthcare, renewable energy, and technology are showing signs of resilience, with steady investments and innovation despite the broader downturn.

- Government Interventions

- Infrastructure spending, tax incentives, and targeted subsidies could provide much-needed support to struggling sectors.

- Global Coordination

- International efforts to stabilize supply chains and resolve geopolitical tensions could alleviate some of the pressures facing the private sector.

Conclusion

The January Flash PMI report paints a sobering picture of global private sector activity, highlighting the challenges of balancing inflation control with economic recovery. As businesses and policymakers navigate this uncertain landscape, a combination of targeted interventions and structural reforms will be crucial to reignite growth and stabilize markets.